net investment income tax 2021 trusts

Estates and trusts that generate income during the year are subject to tax rates set by the federal government. Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts.

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

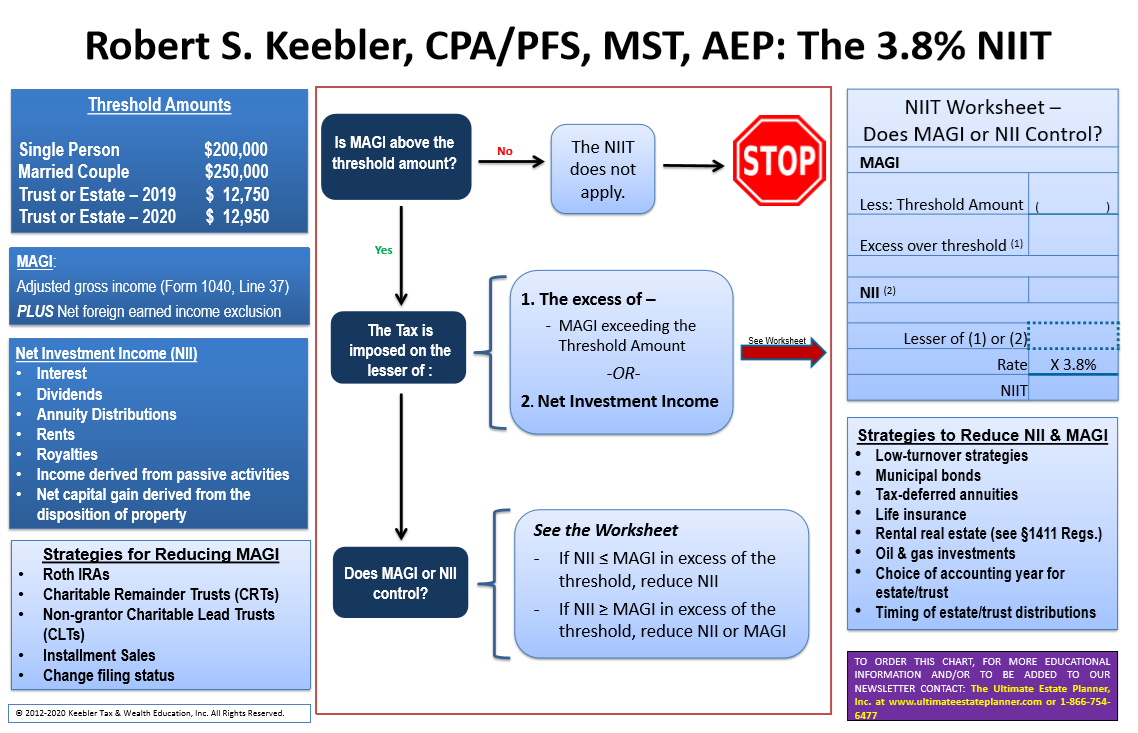

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

. 16 Deferred non-commercial business losses 2021. The GST tax exemption amount which can be applied to generation-skipping transfers including those in trust during 2021 is 117 million increased from 1158 million in. 14 Personal services income PSI 2021.

Form PTE-100 Schedules C and D. IT4 Target foreign income 2021. Possession on income also taxed by California trusts only Pass-Through Entity Elective Tax.

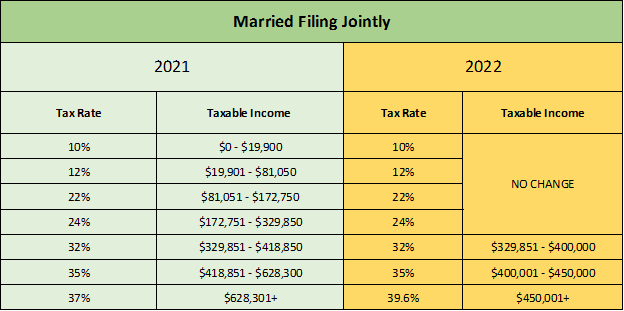

The individual tax. 2021 Schedule of Tax Payments Schedule of Reportable Entities. Below is a summary of the 2021 figures.

13 Partnerships and trusts 2021. It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect. If the submission of tax savings investment or similar documentation is delayed TDS may be deducted by the employer till the required documents have.

These instructions are in the same order as the questions on the Tax return for individuals 2021. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related expenses. Net income tax paid to another state or a US.

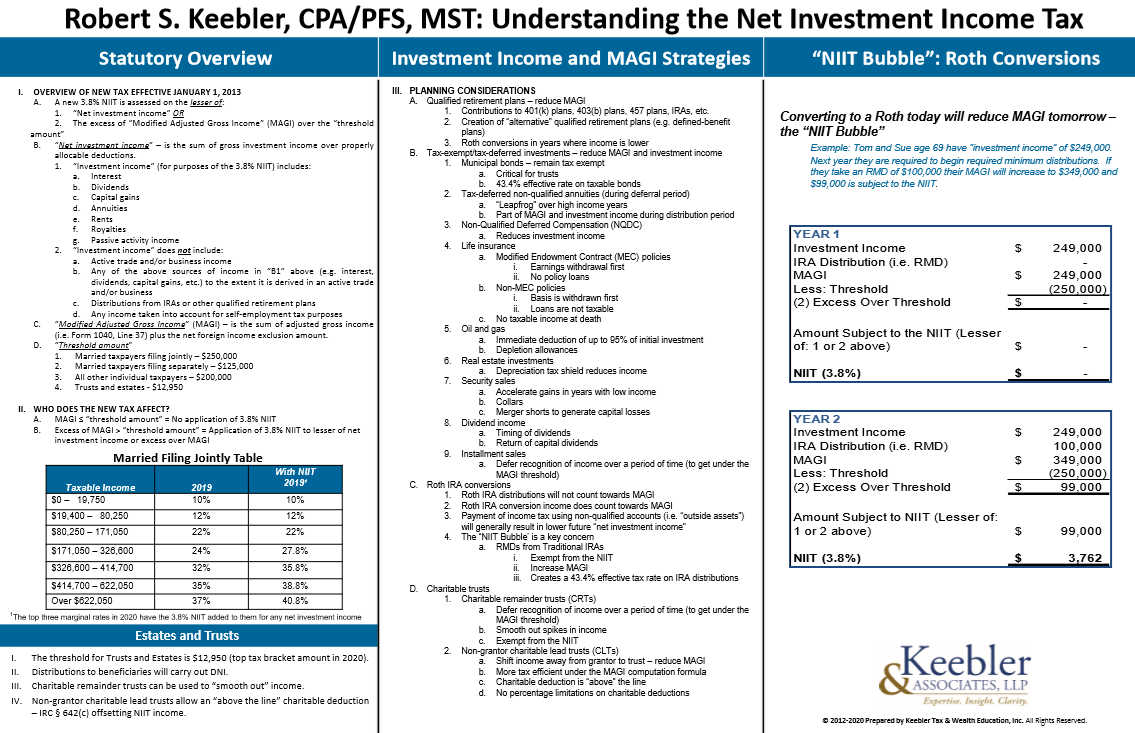

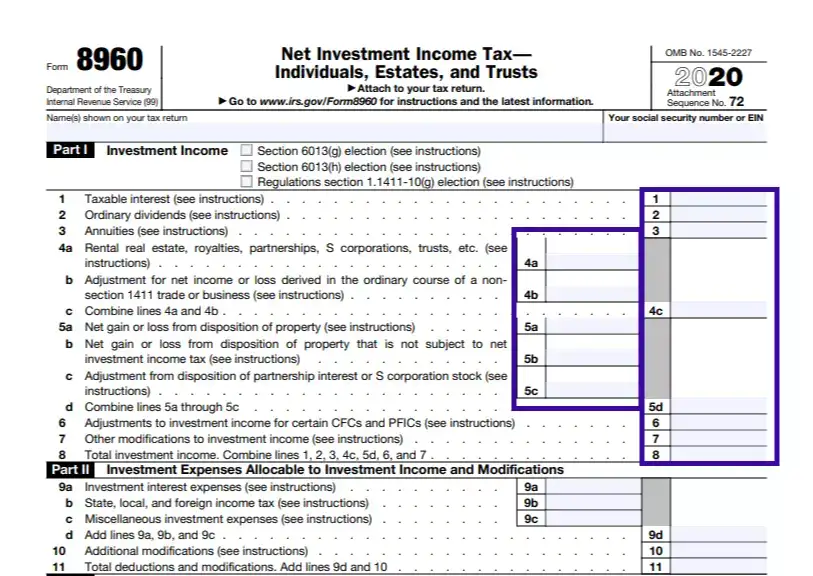

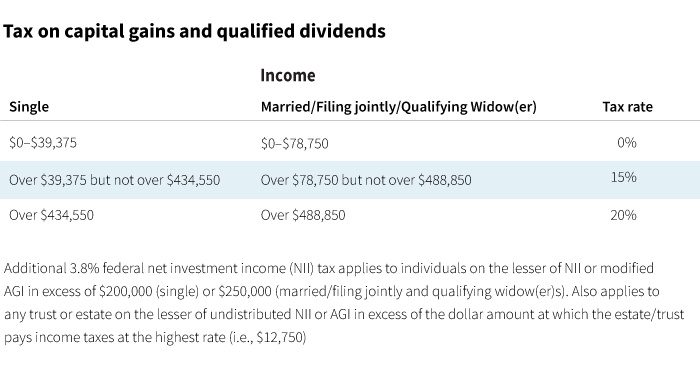

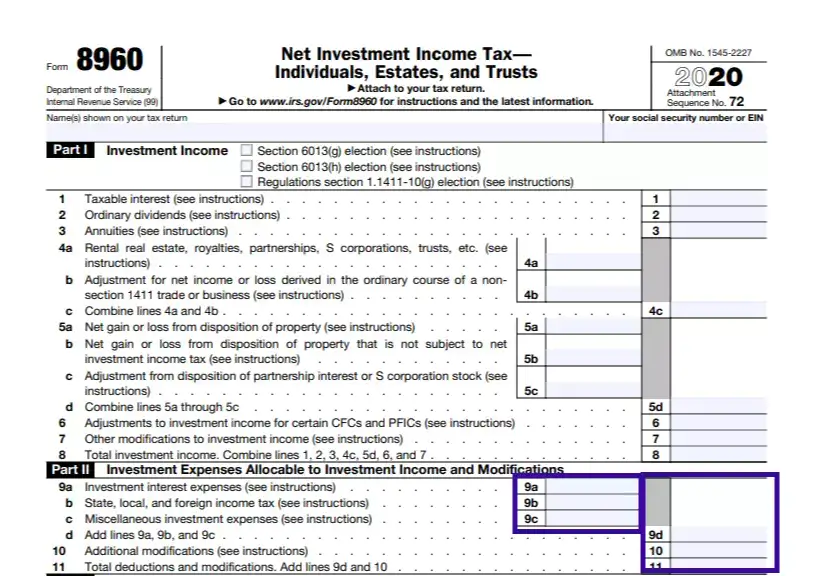

Taxpayers use this form to figure the amount of their net investment income tax NIIT. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. 2021 Gift GST and Trusts Estates Income Tax Rates.

The original news release from the IRS may be found here. Theyre required to file IRS Form 1041 the US. IT5 Net financial investment loss 2021.

Created as part of the Health Care and Education Reconciliation Act to fund healthcare reform in 2010 the net investment income tax NIIT is a 38 surtax that typically applies only to high. Income Tax Return for Estates and Trusts. In general net investment income for purpose of this tax includes but isnt limited to.

18 Capital gains. TaxFormFinder provides printable PDF copies of 96 current Minnesota income tax forms. Minnesota has a state income tax that ranges between 535 and 985 which is administered by the Minnesota Department of Revenue.

Adjusted taxable income ATI for you and your dependants 2021. Those who are over 60-years-old with up to Rs 3 lakh net income the tax rate is nil. Schedule E Investment Income of an RTC Section 23701g 23701i or 23701n Organization.

14 Personal services income PSI 2021. And for very senior citizens who are over 80-years-old up to Rs 5 lakh net income the tax rate is nil. The following information will help you with completing your tax return for 2021.

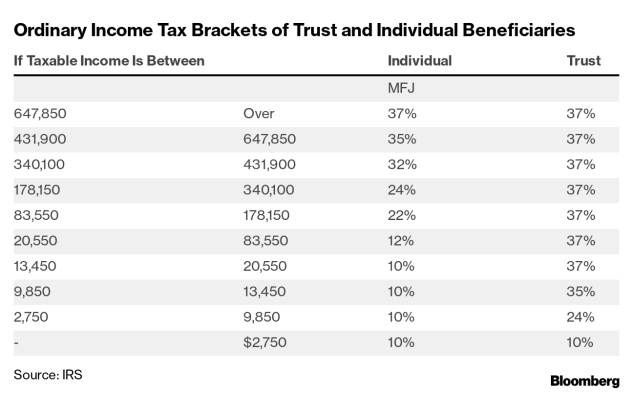

2021 Tax Rate Schedule for Trusts. 13 Partnerships and trusts 2021. Income Tax Voucher for S Corporations and Partnerships.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

17 Net farm management deposits or repayments 2021. The Income Tax Return for Estates and Trusts. The tax brackets are adjusted each year for inflation just as personal income tax brackets are.

15 Net income or loss from business 2021.

What Is The Net Investment Income Tax Caras Shulman

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Client Friendly Charts Handouts Archives Ultimate Estate Planner

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

Irs Form 8960 Fill Out Printable Pdf Forms Online

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Gauge Your Tax Bracket To Drive Tax Planning At Year End

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate The Net Investment Income Properly

Net Investment Income Tax For 1040 Filers Perkins Co

Aca Tax Law Changes For Higher Income Taxpayers Taxact

How To Calculate The Net Investment Income Properly

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

What Is Net Investment Income Tax Overview Of The 3 8 Tax

How To Calculate The Net Investment Income Properly

Irs Form 8960 Fill Out Printable Pdf Forms Online

Net Investment Income Tax Niit Quick Guides Asena Advisors

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Niit Again Planning For The 3 8 Tax On Trust Net Investment Income Preservation Family Wealth Protection Planning