how to claim new mexico solar tax credit

In an effort to encourage people to install solar power in their homes. There are three main steps youll need to take in order to benefit from the ITC.

Federal Solar Tax Credit Guide How To Claim Qualify Leafscore

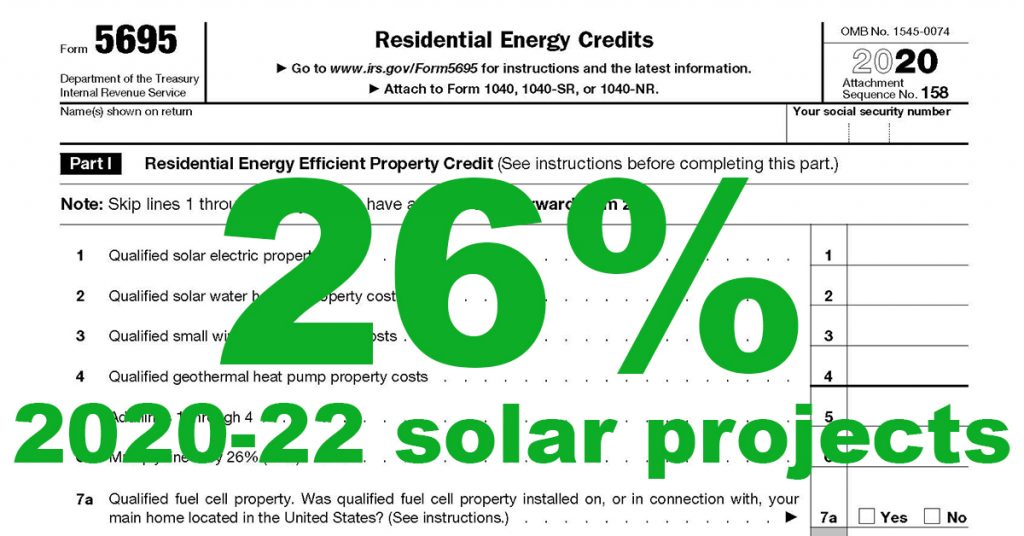

If you buy and install a solar system in 2019 youll claim a tax credit of 30 but if you wait till 2020 the tax credit will have reduced to 26.

. If you install your photovoltaic system before 2032 the federal tax credit is 30 of the cost of your solar panel system. Determine if youre eligible 2. ECMD reviews and approves the production allocation of tax credits among investors in utility-scale wind and solar PV systems installed under this Act until 2026 when the program expires.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. Certificates of Eligibility are sent electronically to the email address provided on the application. Solar power energy provides benefits such as low pollution energy savings and a reduced carbon footprint.

The solar electrical system is filed as qualified solar electric. Use Part I of the form to calculate your credit. To get started download IRS Form 5695 as part of your tax return.

1 2007 can claim a refund for any credits in excess of their tax liability. Homeowners throughout New Mexico can qualify for a 10 tax credit that gets applied to their state income taxes owed for the year the PV system is installed and. Should you have any questions please contact our.

As a credit you take the amount directly off your tax payment. As of 112020 the first year of the tax reduction started with a 4. 10 of the costs of purchase and installation of your Solar PV system up to 9000.

A taxpayer may claim the renewable energy production tax credit by submitting to TRD a completed Form RPD-41227 New Mexico Renewable Energy Production Tax Credit. Nms 10 renewable energy tax credits are set to expire. State of New Mexico - Taxation and Revenue Department RENEWABLE ENERGY PRODUCTION TAX CREDIT Schedule.

What are the steps for claiming solar tax credit in 2022. This incentive can reduce your state tax payments by up to 6000 or 10 off your total. The balance of any refundable credits after paying all taxes due is refunded to you.

New Mexico offers state solar tax credits. This is 30 off the entire cost of the system including equipment. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

New Mexico New Solar Market Development Income Tax Credit El Paso Electric Company EPE Solar Renewable Energy Certificates SRECs and net energy metering NEM program for. Please allow 3-4 weeks for processing of completed applications. Fill Out the Binder of Required PDFs.

We have installed a secure lockbox outside for application drop-off.

.png)

Federal Solar Incentives New Mexico Solar Company

2022 New Mexico Solar Incentives Tax Credits Rebates More

Solar Tax Credit 2022 Incentives For Solar Panel Installations

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Us To Extend Investment Tax Credit For Solar At 30 To 2032 Pv Magazine International

What S In The Inflation Reduction Act For The Solar Industry Pv Magazine International

Solar Energy Tax Incentives By State Northern Arizona Wind Sun

Federal Solar Tax Credit Everything You Need To Know Leafscore

How To Fill Out Irs Form 5695 To Claim The Solar Tax Credit

Federal Solar Tax Credit Being Reduced After 2019 Solar Technologies

How To Take Advantage Of Solar Tax Credits Earth911

Guide To New Mexico Incentives Tax Credits In 2022

How To Claim The Solar Investment Tax Credit Ysg Solar Ysg Solar

2022 New Mexico Solar Incentives Tax Credits Rebates More

Solar Tax Credit Details H R Block

New Mexico Solar Incentives Tax Credits For 2022 Leafscore